Written by,

Ray Nierman

Advisory Analyst

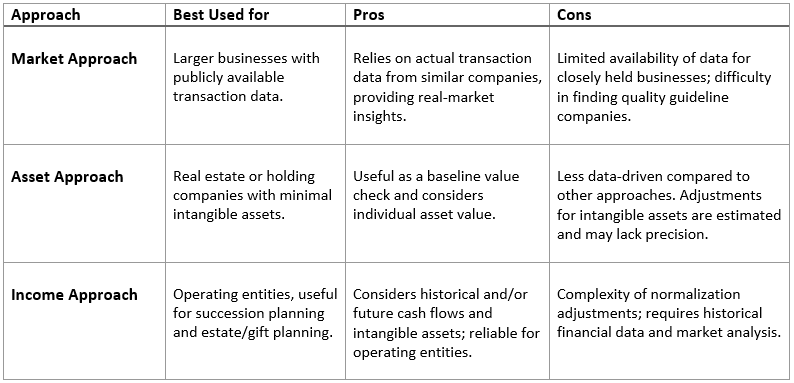

In a recent article, we covered a few common reasons a business owner might need a company valuation. Building upon that foundation, this article will focus on how to apply three general business valuation strategies: the Market Approach, Asset Approach, and Income Approach.

The Market Approach

When determining the value of an asset whether it be a business, car, or a house, sometimes the simplest way to assess its value is the best approach. Determine how much someone else is willing to pay for it, and let that define the value of said asset. This is the core idea behind the market approach – that we should gather data about transactions that include similar companies. Then, we analyze how the differences that exist between those “guideline” company transactions and the one being valued would change the final value of the company. Once those adjustments are considered, we arrive at a final value.

Rules of thumb known as “multiples” are often used for mergers and acquisitions. These consist of reviewing the financial metrics of the business, most often the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and assessing a value based on a multiple of that metric. The multiples are based on data from other company transactions from the same or similar industries.

While seemingly pretty simple, there are a few limitations as to when this approach can be effectively applied. For starters, there is a large market for cars and houses, with many transactions among very similar items, which gives those markets more data points to be able to draw conclusions from. With closely held businesses that are sold in private transactions, all of the information is not released, so valuation experts have less information to draw upon. What makes up a business is also more complicated than what makes up a house or a car. This makes it somewhat rare for valuation experts to find quality guideline companies, especially for smaller businesses. As such, this is a more common approach to use when valuing a larger business, or a business in an industry where transactions are more publicly available.

The Asset Approach

Very similar to the market approach, the asset approach breaks things down a step further. Where the market approach views the market to determine what someone would pay for the business as a whole, the asset approach views the market in an attempt to determine what someone would pay for each of the assets held by the business. There are a few different methods that utilize the core of this approach, including the Net Asset Value, Liquidation, and Excess Earnings methods. Some of them adjust for estimated intangible asset value, while some do not.

With the exception of certain industries, this approach as a whole is usually not weighted very heavily, as when the adjustments are made for intangible assets, they are informed estimates that are not as data-driven as our next approach. This approach is often used as a baseline or minimum value check for valuations, to ensure that values using other methods are reasonable in comparison. The asset approach is more useful in valuing real estate or other holding companies that have minimal intangible assets. Operating entities have a larger portion of value wrapped up in intangible assets and are difficult to value using the asset approach.

The Income Approach

The income approach takes into consideration the net profit of a business in a couple of different ways: the Capitalization of Earnings and Discounted Cash Flows methods. The Capitalization of Earnings method considers 5 years of historical information from the business and assesses a value based on a capitalization rate. The Discounted Cash Flows method considers reasonably expected future cash flows from the business and determines the present value of the business based on a discount rate.

Each of these rates is determined based on the risks taken when purchasing the company and the rate of return that is currently demanded by the market. A more risky company and a higher interest rate will both increase the required rate of return for a purchaser, thereby decreasing the assessed value. There are normalization adjustments made for these methods, which allow for consideration of factors that are likely to change with a different ownership structure. For example, there is a wage adjustment factor to account for the fact that an Owner/Manager will likely pay themselves differently than what a new Owner can hire a Manager for.

This speaks directly to situations where this approach is most applicable. As many of the adjustments account for a difference between owners, these methods are often used for succession planning and gift and estate planning. One strength of this approach is that it inherently considers the intangible assets of the company, so it is a more reliable approach to use for operating entities.

HBE is Here to Help

While there are many business valuation strategies, determining which to use is an important task for your valuation professional to take on. Having a conversation around the purpose of valuation and your business model is an integral part of the valuation process. If you have any upcoming valuation needs, our Valuation Team at HBE is happy to provide you with comprehensive business valuation services and answer any questions you may have.