Written by

Jimmy Schulz, CPA, CVA

Partner | HBE LLP

The Manufacturing Industry looks to face adversity in 2023 with rising interest rates, sharp competition for talent, and greater appeal for specific products. Despite these obstacles, manufacturers can take steps to turn these risks into an advantage for future growth.

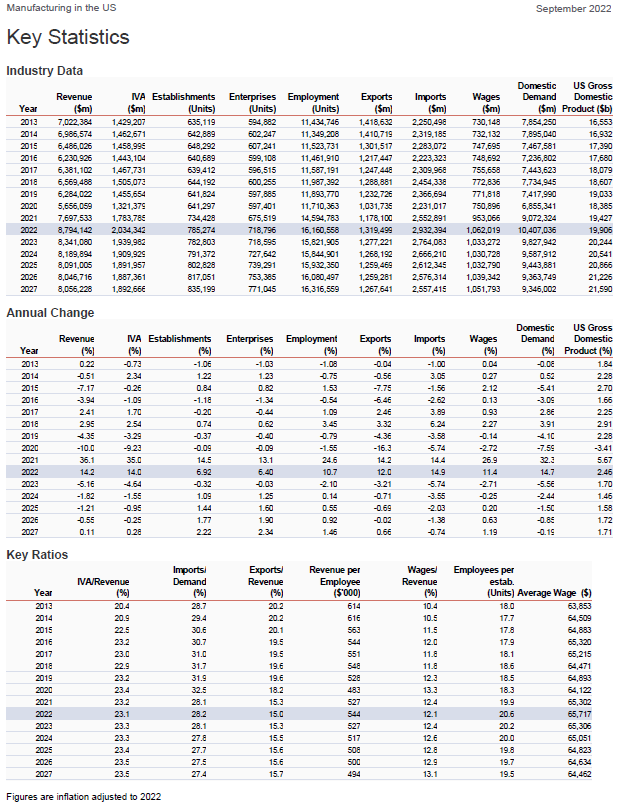

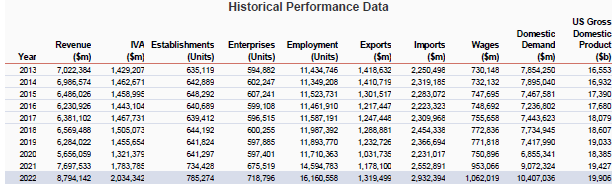

Historical Performance

In recent months, several factors have directly affected the industry, including:

- Spiraling inflation caused product prices to rise.

- Material shortages reduced supplies.

- Factory jobs increased due to government subsidies.

- A focus on new technology and skilled labor lead to increased labor costs.

For 2022, the overall industry revenue climbed 14.2%. Much of this is related to continued recovery from pandemic declines which reached 10% in 2020. Export activities declined and reduced global demand due to trade tensions and volatile commodity prices. Crude oil, a significant external factor to the industry, is expected to increase 54.7% in 2022. Conversely, the price of steel is expected to decrease in 2022.

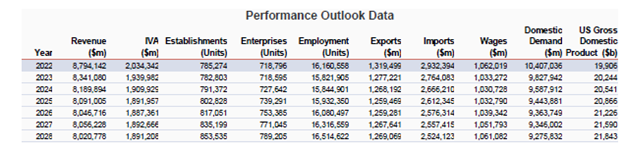

Performance Outlook for 2023 and Beyond

Looking forward at the five-year outlook, the industry is forecasted to decrease. Continued inflation and commodity pricing poses a significant risk in the both the US and global markets. However, the US is posed to be able to benefit and take advantage of opportunities with shifting technology and rising consumer spending.

US manufacturers are relying on and investing in newer technologies to compete with lower cost global manufacturers. In return, this puts more demand on skilled labor and wage pressures for hiring and retention.

Revenue is expected to decline due to volatile commodity processes and a potential decrease in oil and steel prices. Although, a resolution of trade issues with China could boost export revenue in coming years along with rising disposable income and consumer spending.

The tax reform outlook is generally positive for the industry relating to the current 21% corporate tax rate and full expensive of capital investments.

For businesses looking to sell or transition to new ownership in coming months and years, M&A offers a strong market for certain sized manufacturers. With low interest rates, low taxes and more disposable cash for investors, M&A multiples have been strong over the last couple of years. Despite interest rates rising, demand continues with no signs of slowing down.

Act on the Future

We hope this general industry outlook offers additional detailed analysis for your specific manufacturing sector or other key ratio or data points. We encourage you to use these resources to start a discussion with your HBE tax advisor and identify the best strategies for your situation. HBE is available to assist in benchmarking, business planning, projections, specialized tax planning, succession planning, and more.

Data in table sources from https://www.ibisworld.com/.