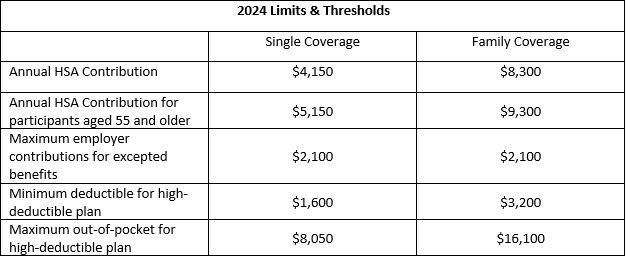

The IRS annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation. The health savings account (HSA) contribution limits effective January 1, 2024, are among the largest HSA increases in recent years.

After the inflation adjustments, the 2024 HSA limits and thresholds are as follows:

Planning for the Transition

Although the changes are not effective until the beginning of 2024, sponsors are encouraged to plan for the transition by discussing implementation changes needed with plan service providers to ensure the new limits are incorporated next year. Additionally, sponsors can also communicate these increases to plan participants to provide them with additional planning opportunities, as increased contributions may be carried over into future years, as discussed further below.

Below we provide key highlights from two recent BDO articles on HSAs:

Despite Growth, HSAs Largely Untapped for Retirement Savings

HSAs have the potential to continue to grow as retirement “piggy banks” that can be:

- Spent tax-free at any time on qualifying medical expenses,

- Retained if not spent during the current year,

- Treated as an additional savings fund with nonmedical distributions before participant reaches age 65 subject to income taxes and an additional 20% penalty, and

- Treated as an additional retirement fund with nonmedical distributions after age 65 subject only to income taxes like individual retirement accounts (IRAs).

Clearing up some common misconceptions about HSAs:

- While their acronyms may sound similar to HSA, health reimbursement accounts (HRAs) and flexible spending accounts (FSAs) differ. Both the employee’s and employer’s contributions to HSAs belong to the employee, even after the termination of employment:

- HRAs are owned and funded by employers and must be left behind when the employee leaves the employer.

- FSAs have a “use it or lose it rule” that generally requires contributions to be used within the year the contribution is made, thereby preventing the FSA from accumulating a balance to serve as long-term savings or retirement funds.

- HSAs require a high-deductible health plan (HDHP) and offer tax advantages for medical expenses.

Tips for Effective HSA Plan Provider Selection

Plan sponsors can use the Employee Benefit Security Administration’s Tip Sheet for Selecting and Monitoring Service Providers:

- Consider the services needed to operate the HSA,

- Review whether the HSA vendor can provide bundled benefit offerings,

- Understand the terms of the contract and have a written record of the hiring process, and

- Regularly evaluate the HSA vendor.

Plan sponsors should also be aware of the key trends:

- Use a consultant or benefits broker to develop the HSA program,

- Important features reported by plan sponsors include having a debit card, 24/7 customer service, and employee engagement/communication, and

- Consider offering investment options based on participants’ needs

To avoid subjecting the HSA to ERISA compliance requirements, plan sponsors should:

- Understand the Department of Labor conditions HSA sponsors must follow to stay outside the realm of ERISA law and

- Avoid requiring employee contributions, limiting fund movements, and making investment decisions (among other things).

Perspective

Sponsors can work with their plan administrators to develop participant communications that highlight the long-term benefits of HSAs (even for healthy employees) and explain how the increased HSA limits for 2024 can boost individual tax-advantaged savings.

Plan participants may not be aware or fully understand the potential benefits offered by HSA contributions:

- Employer contributions to the HSA are not taxed to the employee when paid to the account,

- Employee contributions to the HSA are tax-deductible,

- Invested account balances grow tax-free,

- Funds are not beyond the reach of the employee, but withdrawals might be subject to income taxes and penalties if not used for health expenses:

- Tax-free if used for eligible healthcare purposes,

- Taxable at ordinary income tax rates if used for non-health expenses, and

- Additional 20% penalty owed on non-health distributions made before age 65, and

- Funds are portable, meaning they are not forfeited when the employee changes employers, which allows the individual to have access to the funds as their healthcare needs increase as they age.

A better understanding of HSA provision and the increased limits may spark a participant’s interest in the accounts and provide employers with another vehicle to improve employee satisfaction. Sponsors can work with their plan administrators to develop communication that highlights the long-term benefits of HSAs, even for healthy employees.