Zach Hosek

Accountant

Due to the nature of farming, a farmer’s income can fluctuate significantly from year to year. Factors like commodity prices, input costs, weather conditions, and government support can all shift dramatically, resulting in large income swings. To help offset the tax impact of these fluctuations, the tax code allows farmers to use Schedule J and elect Farm Income Averaging.

What is Farm Income Averaging?

Farm Income Averaging lets farmers spread a portion of their current year’s farm income over the previous three tax years, effectively filling up unused lower tax brackets from those years. This can significantly reduce federal income tax liability when a farmer experiences a high-income year following lower-income years.

What Qualifies as Farm Income?

Eligible farm income includes:

- Income reported on Schedule F

- K-1 income from farming entities (partnerships, S-corporations)

- Including shareholder wages from S-corporations

- Gains or losses on Form 4797 from farm assets (excluding land)

- Crop share rent income

Not included:

- Gains from the sale of farm land

- Cash rent income for farm land

Example: The Power of Farm Income Averaging

Let’s look at an example:

- Filing Status: Married Filing Jointly

- Prior Taxable Incomes:

- 2021: $60,000

- 2022: $50,000

- 2023: $40,000

- Current Year (2024) Taxable Income: $500,000 (all from qualifying farm income)

Scenario 1: No Income Averaging

- Tax on full $500,000 in 2024: $115,750

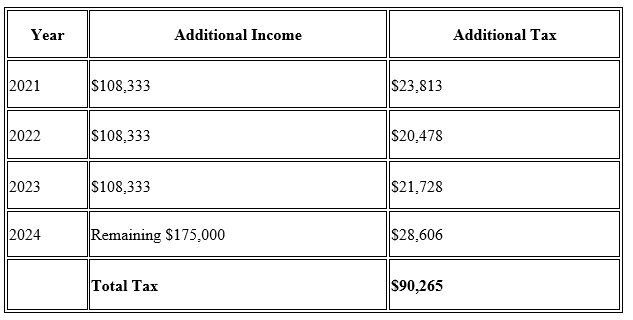

Scenario 2: Elect to Average $325,000

Spread $325,000 equally over 2021, 2022, and 2023 ($108,333 each year)

Tax Savings from Farm Income Averaging: $115,750 – $90,265 = $25,485

Tax Planning

Farm Income Averaging is especially useful when a farmer has:

- A spike in income due to strong commodity prices or government payments

- A wind-down or retirement year with large deferred sales or reduced prepaids

- High income from multi-year grain sales, insurance proceeds, or equipment trades

By anticipating a high-income year, farmers can plan ahead to use income averaging to reduce their tax burden effectively.

Summary

Farm Income Averaging can be a powerful planning tool for farmers. By allowing income from a high-earning year to be taxed using the brackets from previous lower-income years, it helps smooth out the tax impact of agriculture’s naturally volatile income patterns. While not always beneficial, it is one of many strategies that should be reviewed during tax planning season.