June 18, 2025 – The Senate Finance Committee has released its version of the tax provisions for the upcoming budget reconciliation bill. While much of the bill mirrors the House’s overall framework, it includes several important differences that may impact tax planning for both individuals and businesses. Overall, there are some positive changes in this new version of the bill, but there are also some other changes impacting taxpayers. It’s important to note that changes are still likely, as the Senate still needs to vote on the legislation and the House will have to vote again on a final bill, but this shows that progress is being made on finalizing details of a bill.

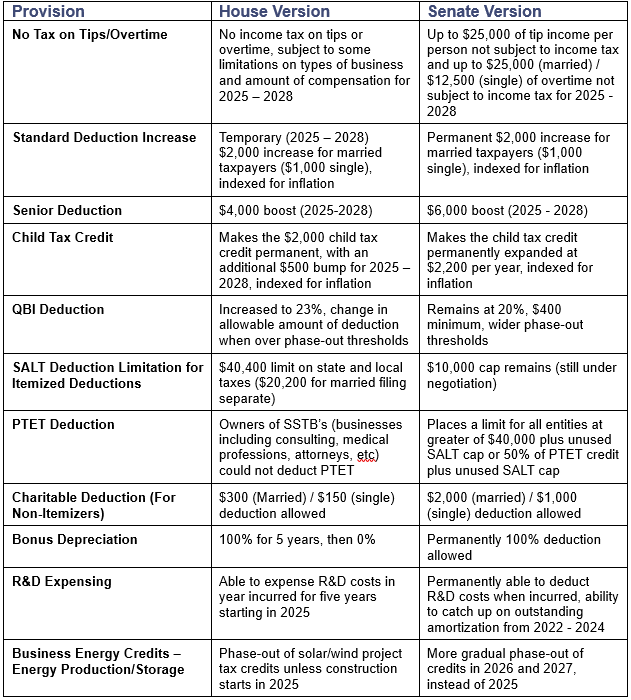

Below is a quick side-by-side comparison of some key differences in the two versions.

Key Differences: House vs. Senate Tax Bills

Stay Tuned

Keep in mind, this bill is not final and is still working its way through Congress. The Senate must still pass their version of the bill, and the House will need to vote again to support the updated legislation. We’re monitoring developments closely and will continue to provide updates as legislation progresses. We expect that there will still be more changes between now and when a final bill passes.

If you have questions or would like to discuss how these changes may impact your tax strategy, please contact your HBE advisor.